WMO of MONDAY to FRIDAY, 2025-2026 DECEMBER 29 to JANUARY 02

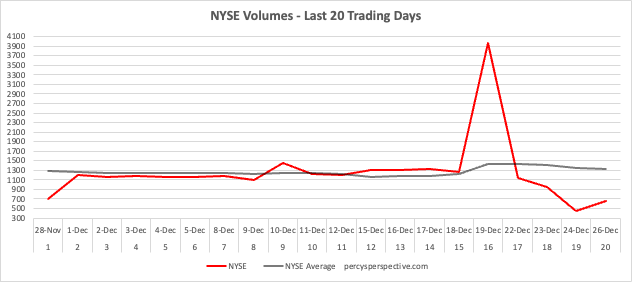

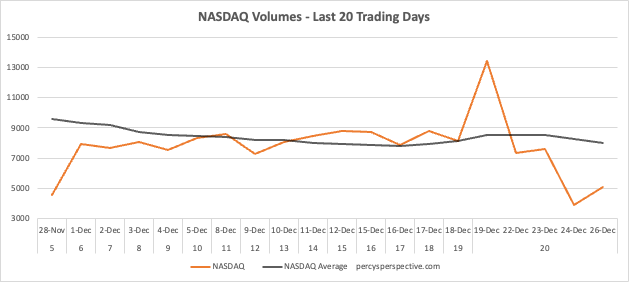

The stock market ended the holiday-shortened week with solid gains across the major averages. The S&P 500 (+1.4%) led the way, capturing fresh record highs. The DJIA (+1.2%) managed to nab a record closing high on Wednesday, while the Nasdaq Composite (+1.2%) still has some ground to cover before it challenges record levels of its own. The S&P Mid Cap 400 (+0.7%) and Russell 2000 (+0.2%) saw an extension of last week’s underperformance, though still managed to finish higher. Trading volumes were lighter than usual, consistent with a holiday week.

Stocks in the information technology sector (+1.8%) were a key driver of the week’s gains, bolstered by strong performances from AI-related names and semiconductors. The PHLX Semiconductor Index (+2.0%) highlighted the sector’s strength. The financials sector (+1.7%) advanced on solid performance in major banking names, while the materials sector (+2.4%) captured the widest sector gain as gold and silver notched fresh record highs.

Only the consumer staples (-0.1%) finished lower.

The week’s gains came as investors digested Q3 GDP, which came in at 4.3%, well above expectations, indicating that the economy was running hot in the quarter and providing a backdrop for the continued strength in growth-oriented sectors.

Overall, nine sectors finished the week with gains of 1.0% or more, highlighting broad participation across the market despite the low-volume holiday week. The major averages continue to trend positive, near record high levels ahead of the final sessions of 2025.

ENCHMARK INDICES YEAR-TO-DATE

- S&P 500: +1.4% WTD

- DJIA: +1.2% WTD

- Nasdaq Composite: +1.2% WTD

- S&P Mid Cap 400: +0.7% WTD

- Russell 2000: +0.2% WTD

THE WEEK IN REVIEW

Monday:

The S&P 500 (+0.6%), Nasdaq Composite (+0.5%), and DJIA (+0.5%) spent the first session of the Christmas week trading in a stable range, capturing decent gains on broad strength. The Russell 2000 (+1.2%) and S&P Mid Cap 400 (+0.9%) notched even wider gains.

Ten S&P 500 sectors finished higher, with four advancing 1.0% or further.

The materials sector (+1.4%) captured the widest gain as silver and gold both set fresh record highs today, with Newmont Corporation (NEM 104.88, +3.59, +3.54%) and Freeport-McMoRan (FCX 50.64, +1.49, +3.03%) outperforming as a result.

Oil prices were also higher today, amid reports that the U.S. is pursuing a third sanctioned tanker off the coast of Venezuela. Crude oil futures settled today’s session $1.50 higher (+2.7%) at $58.03 per barrel, keeping the energy sector (+1.1%) near the top of today’s leaderboard.

Elsewhere the financials sector (+1.3%) was supported by solid gains in its investment manager and major banking names, while aerospace and defense stocks boosted the industrials sector (+1.1%).

While the information technology sector (+0.4%) was not one of the day’s top performers, its modest gain highlights some lingering enthusiasm around the AI trade. Strength in chipmakers saw the PHLX Semiconductor Index close 1.1% higher. NVIDIA (NVDA 183.69, +2.70, +1.49%) provided solid leadership, with Reuters reporting that the company looks to begin H200 shipments to China by mid-February. Additionally, Micron (MU 276.59, +10.67, +4.01%) extended its post-earnings run, and First Solar (FSLR 284.59, +17.61, +6.60%) was the top-performing S&P 500 name.

Only the defensive consumer staples sector (-0.4%), which was a laggard last week amid renewed optimism in the AI trade, finished lower.

In corporate news, Paramount Skydance (PSKY 13.61, +0.56, +4.29%) once again garnered a fair share of coverage today in its takeover bid for Warner Bros. Discovery (WBD 28.75, +0.98, +3.53%). Paramount amended its $30 per share all-cash offer for Warner Bros. Discovery to include an irrevocable personal guarantee of $40.4 billion of the equity financing from Larry Ellison.

There was no economic data of note, and Fed commentary had a minimal impact on the market’s rate-cut expectations for 2026. Fed Governor Stephen Miran (voting FOMC member) told Bloomberg that more rate cuts are needed to avoid risks of a recession, while Cleveland Fed President Beth Hammack (voting FOMC member in 2026) said interest rates should remain unchanged for several months.

All told, today’s session progressed in a relatively uneventful manner, which is unsurprising given the holiday week. Though gains were not as wide as the tech-fueled rally of last Thursday and Friday, the major averages still advanced on broad strength, lifting the S&P 500 to the doorstep of another record high.

U.S. Treasuries began the Christmas week on a modestly lower note, with shorter tenors leading a quiet Monday dip as today’s $69 billion 2-year note auction was met with weak demand. The 2-year note yield settled up two basis points to 3.51%, and the 10-year note yield settled up two basis points to 4.17%.

Tuesday:

The stock market moved steadily higher today as strength in mega-cap technology lifted the major averages alongside improving broader-market participation.

The S&P 500 (+0.5%) notched a fresh record closing high of 6,909.79, while the tech-heavy Nasdaq Composite (+0.6%) finished slightly higher and the DJIA (+0.2%) captured a more modest gain. However, the winning streak would not continue for the smaller-cap Russell 2000 (-0.6%) and S&P Mid Cap 400 (-0.3%), which finished lower after outperforming yesterday.

The information technology sector (+1.0%) mounted a solid intraday climb from negative territory this morning, which helped the major averages move higher after largely trading flat.

NVIDIA (NVDA 189.22, +5.53, +3.01%) and Broadcom (AVGO 349.32, +7.87, +2.30%) led the advance, though a majority of mega-cap tech names traded modestly higher. In sector-related news, the Office of the United States Trade Representative said tariffs on Chinese semiconductors will be implemented, though the rate will remain at 0% for the next 18 months.

Alphabet (GOOG 315.64, +4.31, +1.38%) was another mega-cap standout, helping the communication services sector (+1.0%) tie for the widest gain of the day.

Of the seven S&P 500 sectors that finished higher, the energy sector (+0.6%) was the only other one to capture a gain wider than 0.3%. Crude oil futures settled today’s session $0.37 higher (+0.6%) at $58.40 per barrel.

Losses were just as modest, with the defensive consumer staples (-0.4%) and health care (-0.2%) sectors retreating the furthest while the industrials sector (-0.1%) finished just slightly lower. The real estate sector finished flat.

Breadth steadily improved throughout the session. Decliners outpaced advancers by a roughly 2-to-1 clip on both exchanges this morning, though decliners would finish with a roughly 4-to-3 advantage on the NYSE and a roughly 7-to-4 edge on the Nasdaq.

Still, weakness in the broader market saw the S&P 500 Equal Weighted Index (-0.3%) finish decidedly lower and underperform the market-weighted S&P 500 (+0.5%), which was a beneficiary of the Vanguard Mega Cap Growth ETF’s solid 0.7% gain.

Today’s data slate saw the advance reading of Q3 GDP (4.3%; Briefing.com consensus 3.0%) come in well ahead of expectations. The indication of strong growth at a time when the Fed has been cutting rates invited some concerns about inflation turning out to be more persistent than previously thought, which in turn saw a modest decrease in the markets’ expectations for further rate cuts in the near term.

However, the data also painted a positive picture of the economy, which helped growth stocks outperform amid the low-volume session, sending the major averages higher for the second consecutive day this week.

U.S. Treasuries had a mixed showing on Tuesday, as the 5-year note and shorter tenors reversed from their early highs to record modest losses while the long bond finished in the green, continuing yesterday’s show of relative strength. The U.S. Treasury followed yesterday’s weak 2-year note sale with a 5-year note offering that was also a bit disappointing, but record direct takedown prevented an uglier outcome.

The 2-year note yield settled up two basis points to 3.53%, and the 10-year note yield finished unchanged at 4.17%.

The market will close at 1:00 p.m. ET tomorrow for the Christmas Eve holiday.

Reviewing today’s data:

- Q3 GDP-Adv. 4.3% (Briefing.com consensus 3.0%); Prior 3.8%, Q3 GDP Deflator-Adv. 3.8% (Briefing.com consensus 2.7%); Prior 2.1%

- The key takeaway from the report is that the U.S. economy was certainly running on the warm side in Q3. That will stir some concerns about the Fed’s recent decision to cut rates in December and the risk of stoking increased inflation in pursuit of keeping the economy on a growth trajectory.

- October Durable Orders -2.2% (Briefing.com consensus 0.3%); Prior was revised to 0.7% from 0.5%, October Durable Goods – ex transportation 0.2% (Briefing.com consensus -1.1%); Prior was revised to 0.7% from 0.6%

- The key takeaway from the report is that it was a better indicator of growth than meets the headline eye, evidenced by the 0.7% month-over-month increase in shipments and 0.5% month-over-month increase in new orders for nondefense capital goods excluding aircraft.

- November Industrial Production 0.2% (Briefing.com consensus 0.1%); Prior -0.1%, November Capacity Utilization 76.0% vs (Briefing.com consensus 77.4%); Prior 75.9%

- The key takeaway from the report is that the uptick in November was driven entirely by mining output, which offset the absence of growth in manufacturing output and a 0.4% decline in utilities output.

- December Consumer Confidence 89.1 vs (Briefing.com consensus 89.0); Prior was revised to 92.9 from 88.7

- The key takeaway from the report is that confidence sagged in December due largely to worries about labor market conditions.

Wednesday:

The stock market had a relatively jolly Christmas Eve session today, with broad gains pushing the S&P 500 (+0.3%) to fresh intraday (6,937.32) and closing (6,932.05) highs. The DJIA (+0.6%) notched a record closing high (48,731.16) of its own, while subdued performances across tech names saw the Nasdaq Composite (+0.2%) close with a more modest gain.

Ten S&P 500 sectors finished higher, though gains were modest for the most part.

The consumer staples sector (+0.8%) was a top mover amid a relatively strong day for defensive sectors that also saw the health care (+0.5%) and utilities (+0.6%) sectors notch solid gains. Costco (COST 871.86, +17.07, +2.00%) was a top performer, moving higher after the stock was upgraded to Buy at Northcoast Research, with a target price of $1,100.

Elsewhere, the financials sector (+0.5%) saw a continuation of strength in its banking names, while the real estate sector (+0.7%) also captured a nice gain.

Yesterday’s mega-cap rally fizzled out a bit, with the Vanguard Mega Cap Growth ETF (+0.2%) closing with just a modest gain. NVIDIA (NVDA 188.61, -0.60, -0.32%) gave back some of yesterday’s strength, while Tesla (TSLA 485.40, -0.16, -0.03%) and Alphabet (GOOG 315.67, -0.01, +0.00%) finished flat.

The top-weighted information technology sector (+0.2%) finished modestly higher, with Micron (MU 286.68, +10.41, +3.77%) leading the strength as it continues to rally following its earnings last week.

Only the energy sector (-0.3%) finished lower.

Corporate flow was unsurprisingly light given the early holiday closure today. NIKE (NKE 60.00, +2.66, +4.65%) was the top-performing S&P 500 name following news that Tim Cook (Apple CEO and Nike director) bought 50,000 shares, worth $2.95 million.

Though the action was subdued and the volume was low, the major averages remain positioned at record high levels as the broader market trends in an upwards direction into the end of the year.

The market will be closed tomorrow for the Christmas holiday.

The Treasury market will close at 2:00 pm today, with the entire complex sitting at session highs following a $44 billion 7-year note sale that was met with solid demand. The 2-year note yield is down two basis points to 3.51%, and the 10-year note yield is down four basis points to 4.13%.

Reviewing today’s data:

- Weekly MBA Mortgage Applications Index -5.0%; Prior -3.8%

- Weekly Initial Claims 214K (Briefing.com consensus 226K); Prior 224K, Weekly Continuing Claims 1.923 mln; Prior was revised to 1.885 mln from 1.897 mln

- The key takeaway from the report is the redundancy of the messaging that low initial claims and high continuing claims connote a low firing-low hiring environment that is a speedbump for growth prospects.

Thursday:

The market was closed for the Christmas holiday.

Friday:

The stock market ended the holiday week in muted fashion, though modest early gains saw the S&P 500 (flat) notch an all-time high of 6,945.77. The Nasdaq Composite (-0.1%) and DJIA (flat) also stayed within close proximity of their flatlines today, though all three indices captured solid gains this week of 1.2% or wider.

Leadership was relatively thin today, though a gain in the top-weighted information technology sector (+0.2%) helped weigh against the broader market weakness.

NVIDIA (NVDA 190.53, +1.92, +1.02%) was a mega-cap standout, moving higher after reports it struck a roughly $20 billion Christmas Eve deal with AI inference startup Groq that centers on a non-exclusive licensing arrangement and the acquisition of Groq’s founder, president, and key engineering talent.

Meanwhile, the materials sector (+0.6%) captured the widest gain as precious metals continued to rally. Gold and silver both set all-time highs, which sent prominent mining names Freeport-McMoRan (FCX 53.04, +1.12, +2.16%) and Newmont Corporation (NEM 105.78, +1.05, +1.00%) to fresh 52-week highs.

The real estate (+0.1%) and health care (+0.1%) sectors eked out slight gains as the broader market saw a modest upswing in the last half hour of the session.

While losses were relatively broad-based across the seven other S&P 500 sectors, they were also modest.

The consumer discretionary sector (-0.4%) closed with the widest loss. Tesla (TSLA 475.19, -10.21, -2.10%) was a laggard amid a mixed day for the market’s largest names that saw the Vanguard Mega Cap Growth ETF finish flat.

The sector also faced some profit-taking in its cruise line names, such as Royal Caribbean (RCL 285.64, -8.48, -2.88%), Carnival (CCL 30.70, -0.56, -1.78%), and Norwegian Cruise Line (NCLH 22.83, -0.34, -1.47%). Those stocks have been on a tear recently and still boast stout month-to-date gains after an exceptional earnings report from Carnival.

Like most sessions this week, corporate news flow was light today. Target (TGT 99.55, +3.02, +3.13%) captured the widest gain across S&P 500 names today following a Financial Times report that Toms Capital Investment Management has built a stake in the company.

Outside of the S&P 500, the Russell 2000 (-0.5%) and S&P Mid Cap 400 (-0.2%) underperformed, though they still finished the week with modest week-to-date gains.

All told, today’s session was a low-volume sideways drift that was largely expected given the holiday week. The major averages remain near record high levels as the market searches for fresh catalysts heading into the final sessions of 2025.

U.S. Treasuries finished the Christmas-shortened week on a mixed note, but the Friday session was uneventful, to no one’s surprise. The 2-year note yield settled down three basis points to 3.48% (-3 basis points this week), and the 10-year note yield finished unchanged at 4.14% (-1 basis point this week).

There was no economic data of note.

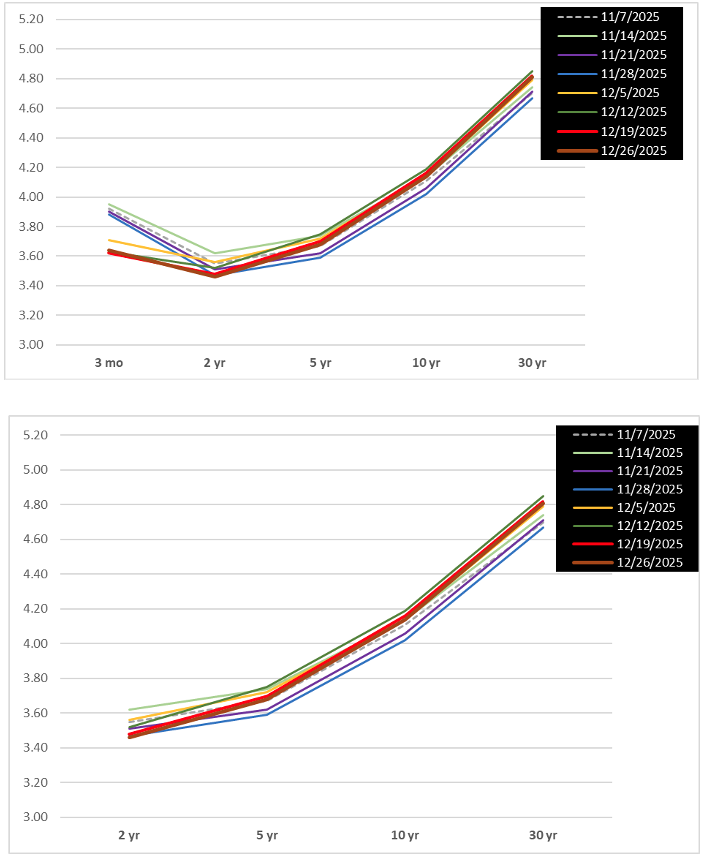

BONDS AND YIELDS

U.S. Treasuries finished the Christmas-shortened week on a mixed note, but the Friday session was uneventful, to no one’s surprise. The trading day started with slim gains after a night that lacked the participation of some markets in Asia and all major European bourses. Treasuries added to their starting gains in early action but ran into resistance once the 30-yr yield dipped below its 200-day moving average (4.788%) while the 5-yr yield approached its 50-day moving average (3.674%). Treasuries remained just below their highs through early morning trade but slipped below their starting levels shortly before noon. However, the dip did not invite additional selling, as the complex nestled into a sideways range again, hovering near session lows into the close. The equity session was also a sleepy one, but precious metals had a big day with gold and silver soaring to fresh records. Silver jumped nearly $6/ozt past $77/ozt, extending this week’s gain to about $10/ozt, while palladium also enjoyed a big rally, soaring $225/ozt past $2000/ozt to its best close in more than three years. Crude oil gave back some of this week’s gain while the U.S. Dollar Index rose 0.1% to 98.05, narrowing this week’s loss to 0.7%.

YIELD CHECK

- 2-yr: -3 bps to 3.48% (-1 bp this week)

- 3-yr: -3 bps to 3.53% (UNCH this week)

- 5-yr: -2 bps to 3.70% (+1 bp this week)

- 10-yr: UNCH at 4.14% (-1 bp this week)

- 30-yr: +2 bps to 4.82% (-1 bp this week)

US 10-Year Yield Edges Higher

The yield on the 10-year US Treasury note edged up to around 4.15% on Friday, reversing a decline from Wednesday, as investors continued to weigh the Federal Reserve’s policy outlook. Market pricing currently implies two additional rate cuts next year. This comes despite the initial estimate for Q3 GDP showing the US economy grew at a 4.3% annualized rate, well above the expected 3.3% and marking the fastest expansion in two years. The strong reading challenges recent concerns that tighter financial conditions have slowed the labor market, supporting arguments from Fed officials favoring a more hawkish stance. Policymakers’ median projection points to only one rate reduction in 2026.

- 3M: +2 bps at 3.64%

- 2Y: -2 bps at 3.46%

- 5Y: -2 bps at 3.68%

- 10Y: -2 bps at 4.14%

- 30Y: -1 bps at 4.81%

The 2Y-30Y bond yield decreased across the board, with the 2Y at its lowest weekly close YTD. The 3M bond increased this week after being on a decline for the last 5 weeks.

EARNINGS

Market not on holiday, but many participants still are

*There is little conviction ahead of the open on what will be a full day of trading for the U.S. market.

*NVIDIA and Groq have entered into a non-exclusive licensing agreement.

*Although it is cold this time of year in many places, the metals trade continues to run hot.

The stock market was closed yesterday for the Christmas holiday, and if one didn’t know any better, you’d think the stock market was still closed today. That isn’t the case.

European markets were closed for Boxing Day, and several markets in the Asia-Pacific region were closed today, but the U.S. stock market (sigh) is open for a full day of trading today.

Currently, the S&P 500 futures are down one point and are trading in line with fair value, the Nasdaq 100 futures are up 17 points and are trading 0.1% above fair value, and the Dow Jones Industrial Average futures are down 48 points and are trading fractionally below fair value.

The lack of conviction in the equity futures trade sums things up well. There isn’t a lot of interest in the stock market today. Trading desks are staffed with skeleton crews, participants normally doing their bidding in the stock market are doing their bidding elsewhere, and federal offices are observing today’s closure by executive order.

CNBC, which always does a great job of covering business news, is allotting excess time this morning to weather updates, perhaps because the Northeast, where it is headquartered, is due to get hit with a snowstorm that is expected to snarl air traffic.

That is a top business story today given the headache it will cause not only for travelers but also for the airlines that are supposed to be doing the flying.

Other top stories include NVIDIA (NVDA) and Groq entering into a non-exclusive inference technology licensing agreement to accelerate AI inference at a global scale, and Digitimes reporting that Adv. Micro Devices (AMD) secured a major Alibaba (BABA) chip order to compete with NVIDIA.

What do you know? Even on a super slow morning for corporate news, the AI trade continues to permeate the market’s psyche. That holds true as well for the metals trade. Silver futures are up 4.5% to $74.81/toz; copper futures are up 3.1% to $5.75/lb; and gold futures are up 1.1% to $4,551.50/toz.

In other developments, the U.S. is stepping up its efforts to seize the Bella 1 oil tanker, according to The Wall Street Journal; China imposed sanctions on U.S. defense companies after President Trump decided to sell weapons to Taiwan, according to Reuters; and Ukrainian President Zelensky is planning to meet with President Trump soon regarding a peace plan, according to Bloomberg.

The Treasury market is also open for a full day of trading today. Currently, the 2-yr note yield is down four basis points to 3.47%, and the 10-yr note yield is down two basis points to 4.12%.

By Patrick J. O’Hare | 2025 DECEMBER 26| Briefing.com

WEEK 01 EARNINGS CALENDAR

- Monday (Dec 29)

- Pre-Market: None

- After-Hours: None

- Pre-Market: None

- After-Hours: None

- Wednesday (Dec 21)

- Pre-Market: None

- After-Hours: None

- Thursday (Jan 1)

- Pre-Market: None

- After-Hours: None

- Friday (Jan 2)

- Pre-Market: None

After-Hours: None

- Pre-Market: None

SEASONALS

With the current POTUS, the seasonals seem totally out of whack. I see no point in using them now.

ANALYSIS

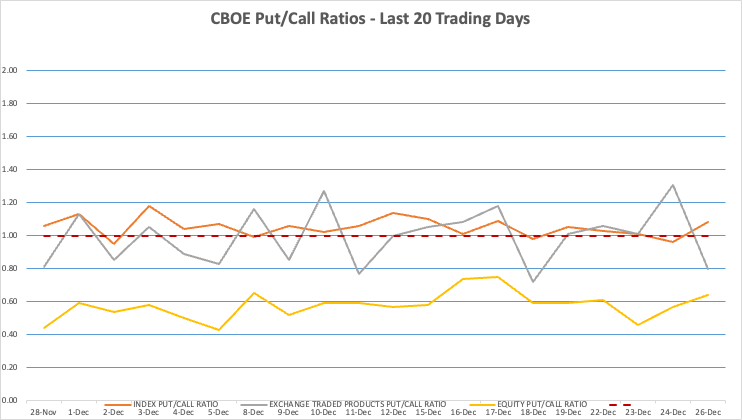

PUT/CALL RATIOS

Any reading above 1.00 is regarded as bearish.

As a common practice amongst the professionals, it is worth noting that the big money indicators are reliably the Index and ETF Put/Call Ratios while the Equity Put/Call Ratios are mostly novice/amateur participation.

PRICE-TO-PRICE DIVERGENCE

VOLUMES

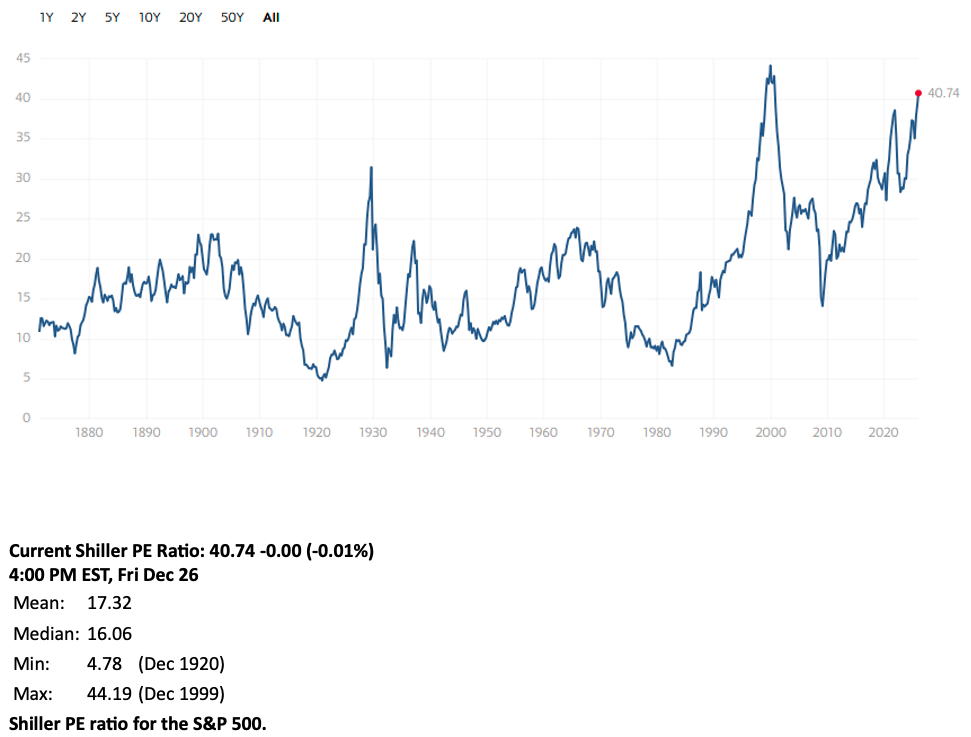

Shiller PE Ratio

The Shiller PE Ratio, as of Fri 26 Dec, is at 40.74, 1.47% higher than the previous week of 40.15. This is the second highest PE ratio for this year.

This is more than double of its mean (17.32) and its median (16.06). At this level, the ratio is above the middle between the historical high (44.19) and the mean or the median. The U.S. market printed its third highest Shiller PE Ratio in its history at 40.88 on 31 October 2025. The largest bubble remains as December 1999 at 44.19.

Daily Monitoring Table (last 5 weeks)

In this week, there were 2 bullish convergent sessions.

Over the last 5 weeks (23 trading sessions), there were 5 bearish divergent sessions, 10 bullish convergent sessions, and 8 divergent sessions (between the daily percentage changes and the market internals).

UVOL/DVOL and Advancers vs Decliners for NYSE and Nasdaq

The Bulls were slightly ahead this week, producing 2 bullish convergent days, while the Bears failed to produce any bearish convergent days, and their ratios were also weaker at less than 3:2 on Tue and Fri.

THE WEEK AHEAD

US Economic Releases

- Mon 29 Dec

- Pending Home Sales m/m

- Tue 30 Dec

- FOMC Meeting Minutes

- Wed 31 Dec

- Unemployment Claims

- Thu 1 Jan

- Market is closed.

- Fri 2 Jan

- Nothing of note

International Releases

- Mon 29 Dec

- Nothing of note.

- Tue 30 Dec

- CN: Manufacturing PMI.

- Wed 31 Dec

- Nothing of note

- Thu 1 Jan

- Nothing of note

- Fri 2 Jan

- Nothing of note

COMMENTARY

LAST WEEK:

As I come to the end of the year, I am asking the same question as last year.

1. Is anyone reading this?

2. Would you, the reader, want me to continue with this?

Please email percival@percysperspective.com and let me know. I am considering shutting this down, as my subscriptions and hosting are resources that could be better used elsewhere.

No one has emailed me. Please let me know if you are reading this. I am in the midst of considering what to do with this blog. Is the information helpful to you?

Happy Hunting.

(Excerpts from briefing.com, tradingeconomics.com, financialscents.com, factset.com, finviz.com, marketwatch.com, etrade.com, yahoo.com, tigerbrokers.com, tradingview.com, tradingcentral.com, theedgemalaysia.com, sectorspdrs.com, Investopedia.com, and CNBC.com)