WMO of MONDAY to FRIDAY, 2025 OCTOBER 13 to OCTOBER 17

The stock market ended the week with its first meaningful pullback in months, as early-week gains and record highs gave way to a broad-based selloff on Friday. The S&P 500 (-2.4%), Nasdaq Composite (-2.5%), and Dow Jones Industrial Average (-2.7%) all finished lower for the week, while smaller-cap indices also retreated, with the Russell 2000 (-3.3%) and S&P MidCap 400 (-3.9%) underperforming. The recent cycle of “buy-the-dip to fresh record highs” was disrupted as investors reacted to renewed trade tensions between the U.S. and China.

Mega-cap technology and AI-related names led the market higher earlier in the week. Advanced Micro Devices (AMD) soared after announcing a multi-gigawatt partnership with OpenAI, while NVIDIA (NVDA), Dell (DELL), and Microsoft (MSFT) also posted strong gains midweek, helping the S&P 500 and Nasdaq Composite achieve record intraday and closing highs. Tesla (TSLA) contributed to early-week momentum with product teasers, though enthusiasm faded following a more modest-than-expected Model Y announcement on Tuesday.

The week’s later selloff was triggered by President Trump’s comments on China and Beijing’s tightening of export controls for rare earths, which reignited trade concerns and prompted broad risk-off sentiment. The information technology (-2.5%), consumer discretionary (-3.3%), communication services, and materials (-3.1%) sectors were among the hardest hit, with the PHLX Semiconductor Index (-2.6%) and Vanguard Mega Cap Growth ETF (-2.2%) reflecting sharp declines in the largest names. The energy sector (-4.0%) also suffered as crude oil prices fell on Friday, while defensive sectors were the lone bright spots: the utilities (+1.4%) and consumer staples (+0.6%) sectors finished the week with gains.

Friday’s selloff was widespread, with decliners outpacing advancers roughly 5-to-1, and marks the most significant macro-driven pullback since sweeping tariff announcements in April.

Treasuries rallied as equities sold off, with the 2-year yield falling to 3.52% and the 10-year settling at 4.05%, approaching September lows. Market attention now shifts to corporate earnings and the potential implications of ongoing geopolitical uncertainty, leaving investors to weigh risk appetite against defensive positioning as the market navigates this post-record higher volatility environment.

BENCHMARK INDICES YEAR-TO-DATE

- Nasdaq Composite: +15.0% YTD (-2.5% WTD)

- S&P 500: +11.4% YTD (-2.4% WTD)

- Russell 2000: +7.4% YTD (-3.3% WTD)

- DJIA: +6.9% YTD(-2.7% WTD)

- S&P Mid Cap 400: +1.3% YTD (-3.9% WTD)

THE WEEK IN REVIEW

Monday:

The Nasdaq Composite (+0.7%) eclipsed its record highs from last week as a result of strength in semiconductor and mega-cap names.

The S&P 500 (+0.4%) came within two points of its all-time high and notched a record closing high, while mixed sector strength saw the DJIA (-0.1%) move lower.

Shares of Advanced Micro Devices (AMD 203.71, +39.04, +23.71%) climbed precipitously this morning after the company announced a deal with OpenAI involving a 6-gigawatt commitment to support OpenAI’s next-generation AI infrastructure using multiple generations of AMD Instinct GPUs. As part of the agreement, OpenAI received a warrant for up to 160 million AMD shares, with vesting tied to deployment volume targets and AMD’s stock performance.

The PHLX Semiconductor Index moved higher in response, finishing with a 2.9% gain, though strength was not entirely ubiquitous throughout the industry. NVIDIA (NVDA 185.51, -2.11, -1.12%) moved lower in response, as AMD’s partnership potentially threatens NVIDIA’s dominant position in AI infrastructure.

Despite the loss in its largest component, the information technology sector (+0.6%) mounted a solid advance today, supported by a nice gain in its second-largest component, Microsoft (MSFT 528.57, +11.22, +2.17%).

Strength in mega-cap names also propelled the consumer discretionary (+1.0%) and communication services (+0.9%) sectors higher today.

Tesla (TSLA 453.25, +23.42, +5.45%) was a notable standout, with shares rising after the company teased a product unveiling for tomorrow on social media.

The Vanguard Mega Cap Growth ETF closed 0.9% higher, and the market-weighted S&P 500 (+0.4%) outperformed the S&P 500 Equal Weighted Index (-0.1%).

Elsewhere, the utilities sector (+1.0%) expanded upon its hot start to the quarter, and the energy sector (+0.5%) advanced as crude oil futures settled today’s session $0.84 higher (+1.4%) at $61.69 per barrel. OPEC+ announced an output hike of 137,000 barrels per day for November, which was in line with reports from last week.

Only the real estate (-1.0%), consumer staples (-0.6%), health care (-0.5%), and financials (-0.1%) sectors closed with losses.

While the market did not have any economic data to digest today, there was a decent amount of corporate news flow.

Fifth Third (FITB 43.79, -0.62, -1.40%) is set to acquire Comerica (CMA 80.19, +9.64, +13.66%) for $10.9 billion in an all-stock transaction that would result in the nation’s ninth-largest bank with approximately $288 billion in assets.

Verizon (VZ 41.43, -2.24, -5.13%) weighed on the DJIA after announcing that former PayPal CEO Dan Schulman will become its new Chief Executive Officer, replacing Hans Vestberg.

OpenAI’s developer event this afternoon saw several stocks move higher after receiving mentions, including Figma (FIG 57.00, +3.96, +7.47%), HubSpot (HUBS 463.53, +11.66, +2.58%), and Salesforce (CRM 245.78, +5.42, +2.25%).

Just before the close, shares of AppLovin (APP 587.00, -95.76, -14.03%) fell sharply after Bloomberg reported that the SEC is probing the company’s data-collection practices after a whistleblower complaint.

Despite a lack of macro catalysts, today’s action reflects the market’s conviction in the AI trade even at record valuations, with mega-caps continuing to drive the index level push into record territory ahead of earnings season.

U.S. Treasuries started the week on a lower note, adding to their losses from Friday. The 2-year note yield settled up three basis points to 3.60%, and the 10-year note yield settled up four basis points to 4.16%.

Tuesday:

The stock market’s opening gains pushed the S&P 500 (-0.4%) and Nasdaq Composite (-0.7%) to fresh record highs before a late morning slip in mega-cap and tech names triggered a broad-based retreat, leaving the major averages devoid of any record closes today.

The DJIA (-0.2%) also closed lower, while the small-cap Russell 2000 (-1.1%) and S&P Mid Cap 400 (-1.1%) underperformed, highlighting the market’s risk-off disposition today.

Only the defensive consumer staples (+0.9) and utilities (+0.4%) sectors created any sort of positive distance from their flat lines. Some late afternoon buying activity saw the financials, energy, and health care sectors all close with 0.1% gains.

Meanwhile, the consumer discretionary sector (-1.4%) finished with the widest loss, as Tesla’s (TSLA 433.09, -20.16, -4.45%) release of a more affordable, rear-wheel-drive Model Y failed to live up to the hype that its teased announcement generated yesterday.

Ford Motor (F 11.92, -0.77, -6.07%) added to the auto woes today, sliding after The Wall Street Journal reported that a fire at an aluminum supplier plant could disrupt the business for months.

The sector also faced pressure in its homebuilder names, sending the iShares U.S. Home Construction ETF 3.1% lower.

Mega-cap weakness contributed to losses in the communication services (-0.7%) and information technology (-0.5%) sectors, with the Vanguard Mega Cap Growth ETF closing with a 0.6% loss.

While the technology sector did not close with the widest loss today, its reversal from an earlier gain prompted the major averages to retreat beneath their flat lines.

The sector got off to a hot start after IBM (IBM 293.89, +4.47, +1.54%) announced a partnership with Anthropic, Dell (DELL 150.85, +5.09, +3.49%) increased its long-term annual revenue growth expectations, and Advanced Micro Devices (AMD 211.51, +7.80, +3.83%) continued to build on yesterday’s momentum after announcing a partnership with OpenAI.

Just before midday, the sector slipped into negative territory following a report from The Information that suggested Oracle (ORCL 284.57, -7.02, -2.41%) will face financial challenges renting out NVIDIA (NVDA 185.04, -0.50, -0.27%) chips.

The PHLX Semiconductor Index would go on to finish with a 2.1% loss after an early gain.

Though today’s retreat was broad-based, it was also modest. The S&P 500 and Nasdaq Composite both sit on their flatlines for the week, while the DJIA holds a modest 0.3% week-to-date loss. The lingering lack of macro developments combined with a few negative corporate headlines kept the major averages range-bound for the majority of the session. While a buy-the-dip move did not transpire today, the major averages remain within striking distance of their fresh record highs.

U.S. Treasuries overcame some opening weakness on Tuesday, recording their first higher finish since Thursday. The 2-year note yield settled down three basis points to 3.57%, and the 10-year note yield settled down four basis points to 4.13%.

Reviewing today’s economic data:

- Consumer credit increased by $0.4 billion in August (Briefing.com consensus: $13.1 billion) following an upwardly revised $18.0 billion increase (from $16.0 billion) in July.

- The key takeaway from the report is that the expansion in consumer credit was miniscule in August due to a decrease in revolving credit, which saw its biggest decrease since March.

Wednesday:

The S&P 500 (+0.6%) and Nasdaq Composite (+1.1%) both notched record intraday and closing highs today, supported by a strong, wire-to-wire performance from the information technology sector (+1.5%).

While the broader market largely advanced as well, certain pockets of weakness in the market saw the DJIA close on its flat line.

The technology sector was primed for upward momentum before the opening bell, as NVIDIA (NVDA 189.06, +4.02, +2.17%) CEO Jensen Huang joined CNBC, offering generous remarks about the prospects of OpenAI and other AI companies while also stating that the “demand of computing has gone up substantially.”

Chipmaker names delivered on the early hype today, with the PHLX Semiconductor Index advancing 3.4% on the day. Advanced Micro Devices’ (AMD 235.56, +24.05, +11.37%) impressive gain was the best in the S&P 500, building on momentum from earlier in the week after announcing a partnership with OpenAI.

Dell (DELL 164.53, +13.66, +9.05%) also expanded upon news catalysts from earlier this week, capturing another sizable gain after announcing an increase to its long-term annual revenue growth expectations yesterday.

While the information technology sector held several of the best-performing S&P 500 names today, it is also home to the biggest laggard in Fair Isaac (FICO 1695.01, -184.54, -9.82%). FICO’s recent rally stalled after Equifax (EFX 239.68, +1.69, +0.71%) countered its new Mortgage Direct License Program with a 50% price cut on VantageScore 4.0 and free access for customers purchasing FICO scores through 2026.

In total, six S&P 500 sectors would finish in positive territory, with the industrials (+0.9%), utilities (+0.7%), and consumer discretionary (+0.6%) sectors also capturing nice gains.

Meanwhile, the energy sector (-0.6%) finished with the widest loss despite crude oil futures settling today’s session $0.85 higher (+1.4%) at $62.57 per barrel.

Major banking names weighed on the financials sector (-0.5%), while the consumer staples sector (-0.5%) gave back some of yesterday’s gain, and the real estate sector (-0.5%) continued to slip this week.

Though breadth figures slightly deteriorated throughout the afternoon as losses widened in the retreating sectors, advancers still held an edge at the close. Advancers outpaced decliners by a roughly 8-to-5 ratio on the NYSE and a nearly 2-to-1 clip on the Nasdaq.

Smaller cap indices such as the Russell 2000 (+1.0%) and S&P Mid Cap 400 (+1.0%) outperformed today, garnering some buy-the-dip attention after facing pressure this week.

While today’s action resulted in strong finishes and record highs for the S&P 500 and Nasdaq Composite, it was relatively quiet from a news flow perspective.

The release of the September FOMC minutes did little to the standing of the major averages or the market’s expectations for further easing this year.

The minutes showed that most officials believe it will likely be appropriate to ease policy further before year-end, and also highlighted that markets viewed recent data and FOMC communications as signaling little change in the baseline outlook, though downside risks to the labor market were seen as having increased.

Tomorrow’s jobless claims data is unlikely to be released amid the ongoing government shutdown, leaving the market lacking in macro developments, though earnings reports will begin to ramp up.

U.S. Treasuries finished Wednesday on a slightly lower note after retreating from their morning highs. The 2-year note yield settled up one basis point to 3.58%, and the 10-year note yield finished unchanged at 4.13%.

Reviewing today’s economic data:

- The weekly MBA Mortgage Index fell 4.7% to follow last week’s 12.7% drop. The Refinance Index was down 7.7% while the Purchase Index was down 1.2%.

Thursday:

The stock market’s modest opening advance was enough to secure new record highs for the S&P 500 (-0.3%) and Nasdaq Composite (-0.1%), though a broad-based retreat quickly ensued, sending the major averages lower.

The DJIA (-0.5%) underperformed the group, staying in negative territory for the week.

While sector strength was split this morning, it deteriorated throughout the session, leaving just the consumer staples sector (+0.6%) in positive territory at the close.

Other defensive sectors spent considerable amounts of time above their baselines as well, but a handful of corporate developments saw the consumer staples sector maintain its advantage through the close.

Costco (COST 942.89, +28.09, +3.07%) captured a nice gain after reporting an increase in comparable sales of 6.0% for the month of September.

PepsiCo (PEP 144.73, +5.89, +4.24%) reported an earnings beat, and Kenvue (KVUE 16.84, +0.76, +4.70%) was one of the best-performing names in the S&P 500, continuing its rebound from recent record lows.

As for the declining sectors, the materials sector (-1.5) saw the widest loss despite Albemarle (ALB 96.50, +4.81, +5.25%) finishing as the best-performing S&P 500 name. Gold finally saw a pullback from its run to record highs, settling today’s session $93.90 lower (-2.3%) at $3,976.50 per ounce.

The industrials sector (-1.4%) also lagged, even though Delta Air Lines (DAL 59.57, +2.45, +4.29%) captured a nice gain after beating EPS and revenue expectations, which sent United Airlines (UAL 101.34, +3.25, +3.31%) higher as well.

The sector faced pressure in its defense names after China’s Ministry of Commerce announced the tightening of export restrictions on rare earth materials for high-tech products and military applications, sending the iShares US Aerospace and Defense ETF 1.8% lower.

The energy sector (-1.3%) rounds out the three S&P 500 sectors to close with a loss wider than 1.0%, moving lower as crude oil futures settled today’s session $1.15 lower (-1.8%) at $61.42 per barrel.

This morning’s retreat was initially led by the consumer discretionary (-0.2%) and communication services (-0.1%) sectors, which faced early pressure in their mega-cap components, though the market’s largest names would go on to finish well off their session lows.

Tesla (TSLA 435.46, -3.23, -0.74%) narrowed its early loss by nearly two percentage points, while Meta Platforms (META 733.51, +15.67, +2.18%) and Amazon (AMZN 227.74, +2.52, +1.12%) captured nice gains.

NVIDIA (NVDA 192.57, +3.46, +1.83%) also contributed with a strong performance after receiving a target raise to $300 from $240 at Cantor Fitzgerald. In conjunction with Oracle’s (ORCL 297.04, +8.41, +2.91%) advance, the information technology sector (-0.1%) stayed close to its flatline despite a majority of components moving lower.

The Vanguard Mega Cap Growth ETF (-0.1%) also closed just beneath its baseline after facing a loss of 0.5% earlier in the session.

Today’s action once again featured a lack of notable macro catalysts. The market did not receive any economic data of note due to the ongoing government shutdown, the Senate once again failed to pass a funding bill to end the shutdown, and none of today’s FOMC speakers said anything to nudge the market’s rate cut expectations in one way or another.

While the lack of drivers made for an uneventful afternoon, a late session pickup in buying among the market’s largest names suggests investors may already be looking to capitalize on another buy-the-dip play.

U.S. Treasuries saw some selling early in the cash session that resulted in yields drifting higher across the curve. The 2-year note yield settled up two basis points to 3.60%, and the 10-year note yield settled up two basis points to 4.15%.

Friday:

The stock market endured its sharpest pullback in months after President Trump reignited trade tensions with China, sparking a broad-based selloff that erased the week’s gains.

The S&P 500 (-2.7%) registered its worst session since April, while the Nasdaq Composite (-3.6%) and Dow Jones Industrial Average (-1.9%) also faced sharp retreats. The small-cap Russell 2000 (-3.0%) and S&P Mid Cap 400 (-2.8%) also underperformed as investors rotated out of risk assets in response to the renewed geopolitical uncertainty.

Stocks opened higher as traders attempted another buy-the-dip effort following yesterday’s retreat, but sentiment reversed after President Trump posted on Truth Social that China is “becoming very hostile,” that he saw “no reason” to meet with President Xi at the upcoming APEC Summit, and that the U.S. is weighing a “massive increase” of tariffs on Chinese imports.

The post, which followed Beijing’s decision to tighten export controls on rare earth materials, triggered an immediate wave of selling that persisted through the afternoon.

The ensuing sell-off touched nearly every corner of the market. The information technology (-4.0%), consumer discretionary (-3.3%), and communication services (-2.3%) sectors were among the worst performers, pressured by tariff-sensitive and high-beta names.

The Vanguard Mega Cap Growth ETF slid 3.3%, as the market’s largest names paced the decline throughout the session.

The Philadelphia Semiconductor Index dropped 6.3% as chipmakers, including NVIDIA (NVDA 183.04, -9.52, -4.95%) and Advanced Micro Devices (AMD 214.76, -18.13, -7.78%), faced additional pressure after Bloomberg reported that the Senate passed legislation to limit AI chip exports to China from the two companies.

Crude oil, meanwhile, extended its slide, falling $2.48 (-4.0%) to $58.94 per barrel on renewed global growth concerns, sending the energy sector (-2.8%) sharply lower.

On the upside, the rare earth and critical mineral space provided a rare pocket of strength. MP Materials (MP 78.51, +6.22, +8.60%) and related domestic producers rallied on expectations of U.S. countermeasures to China’s export restrictions.

The defensive consumer staples (+0.3%) also held firm, finishing the day as the only S&P 500 sector in positive territory. PepsiCo (PEP 150.08, +5.37, +3.71%) was the top advancing name in the S&P 500, as today’s defensive sentiment combined with continued post-earnings strength.

After a long stretch of low-volatility sessions, the market finally encountered a meaningful macro shock, breaking the recent pattern of steady buy-the-dip advances. President Trump’s comments reignited trade tension and prompted broad profit-taking across nearly every pocket of the market. Decliners outpaced advancers by a roughly 5-to-1 ratio on the NYSE and Nasdaq, sending the major averages into negative territory for the week.

U.S. Treasuries finished the week on a firmly higher note, sending yields toward their September lows, with the 30-year yield settling at a level not seen since early April. The 2-year note yield settled down eight basis points to 3.52%, the 10-year note yield settled down ten basis points to 4.05%, and the 30-year note yield settled down ten basis points to 4.63%.

Reviewing today’s data:

- The preliminary University of Michigan Consumer Sentiment reading for October checked in at 55.0 (Briefing.com consensus: 54.5) versus the final reading of 55.1 for September. In the same period a year ago, the index stood at 70.5.

- The key takeaway from the report is that consumers are not expecting any meaningful improvement in prices or job prospects, a view that could potentially crimp their discretionary spending activity.

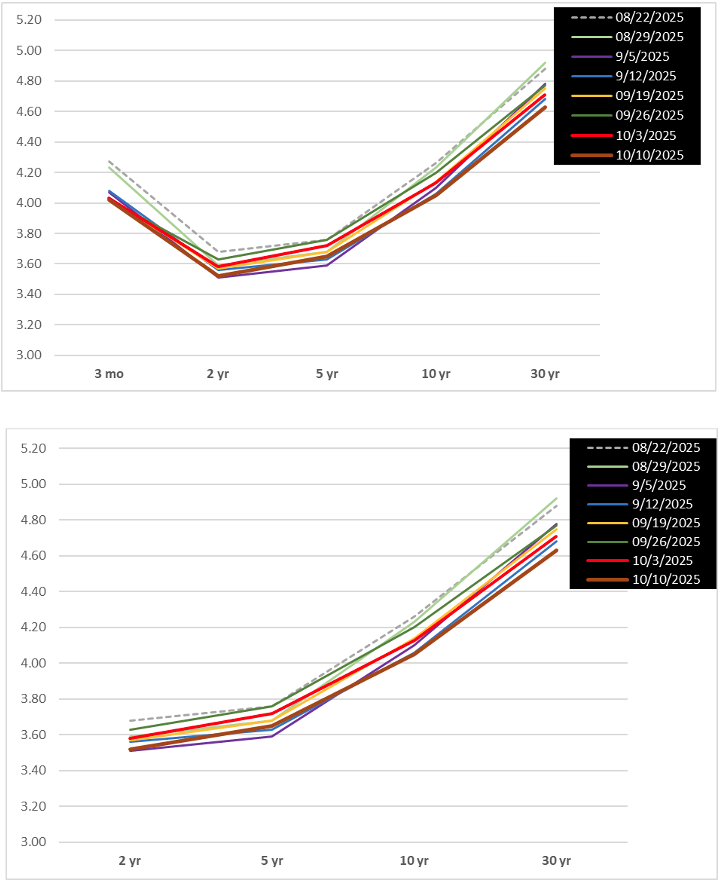

BONDS AND YIELDS

U.S. Treasuries finished the week on a firmly higher note, sending yields toward their September lows with the 30-yr yield settling at a level not seen since early April. Treasuries got off to a solid start after an overnight advance in the futures market, which coincided with gains in other sovereign debt. There was some hope that France would avoid a snap election after it was reported that President Macron will attempt to name another prime minister soon, his sixth in under two years. Treasuries spent the bulk of the morning in a sideways range near their starting levels with the front end seeing some light pressure. The entire complex jumped to fresh highs in the late morning and built on the rally into the afternoon after President Trump took to social media to express his disappointment with China’s intensifying export controls. The president said that this could prompt a big increase to tariffs on goods from China and that he no longer sees the need to meet with China’s President Xi during the Asia-Pacific Economic Cooperation Forum in South Korea at the end of the month. The threat of additional tariffs spurred some notable selling in the stock market while the extension of the rally in Treasuries left yields at multi-week lows. Crude oil fell to its lowest level since early May, giving up $1.91, or 3.1%, for the week, while the U.S. Dollar Index fell 0.6% to 98.95, reversing from its best level since early August. The Treasury market will be closed on Monday in observance of Columbus Day, but the New York Stock Exchange will be open for a full session.

YIELD CHECK

- 2-yr: -8 bps to 3.52% (-5 bps this week)

- 3-yr: -9 bps to 3.53% (-6 bps this week)

- 5-yr: -10 bps to 3.65% (-6 bps this week)

- 10-yr: -10 bps to 4.05% (-7 bps this week)

- 30-yr: -10 bps to 4.63% (-8 bps this week)

BOND YIELDS

Treasury Yields Drop Further After Trump’s Threats on China

The yield on the US 10-year Treasury note fell further to 4.06% on Friday, its lowest level in nearly three weeks, fully erasing the gains from earlier in the week amid growing concerns over a renewed US-China trade war. President Trump threatened a “massive increase in tariffs” on Chinese imports in response to Beijing’s plans to tighten export controls on rare earths, and also hinted he might cancel his upcoming meeting with President Xi Jinping, heightening geopolitical tensions. The remarks came after a series of measures from China earlier in the week, including new port fees on US ships and an antitrust investigation into Qualcomm. Meanwhile, the federal government shutdown entered its tenth day, further delaying the release of key economic data and likely postponing next week’s scheduled releases, including CPI. Investors continue to price in a 25-basis-point rate cut by the Fed later this month, with the probability of another move in December holding around 83%.

- 3M: -1 bps at 4.02%

- 2Y: -6 bps at 3.52%

- 5Y: -7 bps at 3.65%

- 10Y: -8 bps at 4.05%

- 30Y: -8 bps at 4.63%

3M yield is at its lowest YTD. The yield curve reduced for all tenors. Bond yields are inversely proportional to its prices: a reduction in bond yields indicate an increase in bond prices, i.e. more buying pressure.

EARNINGS

S&P 500 Earnings Season Preview: Q3 2025

Heading into the start of the earnings season, analysts and companies have been more optimistic than normal in their earnings outlooks for the third quarter. As a result, estimated earnings for the S&P 500 for the third quarter are higher today compared to expectations at the start of the quarter. On a year-over-year basis, the index is expected to report earnings growth for the 9th consecutive quarter.

In terms of estimate revisions for companies in the S&P 500, analysts increased earnings estimates for Q3 2025 during the quarter. On a per-share basis, estimated earnings for the third quarter increased by 0.1% from June 30 to September 30. In a typical quarter, analysts usually lower earnings estimates during the quarter. Over the past five years (20 quarters), earnings expectations have fallen by 1.4% on average during a quarter. Over the past ten years, (40 quarters), earnings expectations have fallen by 3.2% on average during a quarter.

In terms of guidance, both the number and percentage of S&P 500 companies issuing positive EPS guidance for Q3 2025 are higher than average. At this point in time, 112 companies in the index have issued EPS guidance for Q3 2025. Of these companies, 57 have issued negative EPS guidance and 55 have issued positive EPS guidance. The number of companies issuing positive EPS guidance is well above the 5-year average (42) and well above the 10-year average (39). The percentage of S&P 500 companies issuing positive EPS guidance for Q3 2025 is 49% (55 out of 112), which is also well above the 5-year average of 43% and well above the 10-year average of 39%.

Due to the upward revisions to earnings estimates by analysts and the positive EPS guidance issued by companies, the estimated (year-over-year) earnings growth rate for Q3 2025 is higher today relative to the start of the third quarter. As of today, the S&P 500 is expected to report (year-over-year) earnings growth of 8.0%, compared to the estimated (year-over-year) earnings growth rate of 7.3% on June 30.

If 8.0% is the actual growth rate for the quarter, it will mark the 9th consecutive quarter of year-over-year earnings growth for the index.

Seven of the eleven sectors are projected to report year-over-year growth, led by the Information Technology, Utilities, Materials, and Financials sectors. On the other hand, four sectors are predicted to report a year-over-year decline in earnings, led by the Energy and Consumer Staples sectors.

In terms of revenues, analysts also raised their estimates during the quarter. As of today, the S&P 500 is expected to report (year-over-year) revenue growth of 6.3%, compared to the expectation for revenue growth of 4.8% on June 30.

If 6.3% is the actual revenue growth rate for the quarter, it will mark the second-highest growth rate reported by the index since Q3 2022 (11.0%), trailing on the previous quarter. It will also mark the 20th consecutive quarter of revenue growth for the index.

Ten sectors are projected to report year-over-year growth in revenues, led by the Information Technology, Communication Services, and Health Care sectors. On the other hand, the Energy sector is the only sector predicted to report a year-over-year decline in revenues.

For Q4 2025 through Q2 2026, analysts are calling for earnings growth rates of 7.4%, 11.7%, and 12.7%, respectively. For CY 2025 analysts are predicting (year-over-year) earnings growth of 10.9%.

The forward 12-month P/E ratio is 22.8, which is above the 5-year average (19.9) and above the 10-year average (18.6). This P/E ratio is also above the forward P/E ratio of 22.1 recorded at the end of the second quarter (June 30).

During the upcoming week, 37 S&P 500 companies (including 5 Dow 30 components) are scheduled to report results for the third quarter.

Insight/2025/10.2025/10.10.2025_Earnings%20Insight/001-number-of-sp500-companies-with-q3-positive-and-negative-guidance.png?width=672&height=384&name=001-number-of-sp500-companies-with-q3-positive-and-negative-guidance.png)

Insight/2025/10.2025/10.10.2025_Earnings%20Insight/02-sp500-q325-bottom-up-eps-june-30-to-september-30.png?width=672&height=384&name=02-sp500-q325-bottom-up-eps-june-30-to-september-30.png)

Insight/2025/10.2025/10.10.2025_Earnings%20Insight/03-sp500-earnings-growth-q3-2025.png?width=672&height=384&name=03-sp500-earnings-growth-q3-2025.png)

Insight/2025/10.2025/10.10.2025_Earnings%20Insight/04-sp500-revenue-growth-q3-2025.png?width=672&height=384&name=04-sp500-revenue-growth-q3-2025.png)

By John Buters | 2025 OCTOBER 10 | Factset.com

WEEK 42 EARNINGS CALENDAR

- Monday (Oct 13)

- Pre-Market: FAST

- After-Hours: None

- Pre-Market: ACI BLK C DPZ ERIC FBK GS JNJ JPM WFC

- After-Hours: HWC

- Wednesday (Oct 15)

- Pre-Market: ABT ASML BAC CFG FHN MS PNC PGR PLD SYF

- After-Hours: FR HOMB JBHT PNFP REXR SLG SNV TFIN UAL

- Thursday (Oct 16)

- Pre-Market: BK SCHW CMC IIIN KEY MTB MAN MMC SNA TRV TSM USB

- After-Hours: OZK CNS CSX FNB GBCI IBKR LBRT SFNC

- Friday (Oct 17)

- Pre-Market: ALLY AXP ALV CMA FITB HBAN RF SLB STT TFC WBS

After-Hours: None

- Pre-Market: ALLY AXP ALV CMA FITB HBAN RF SLB STT TFC WBS

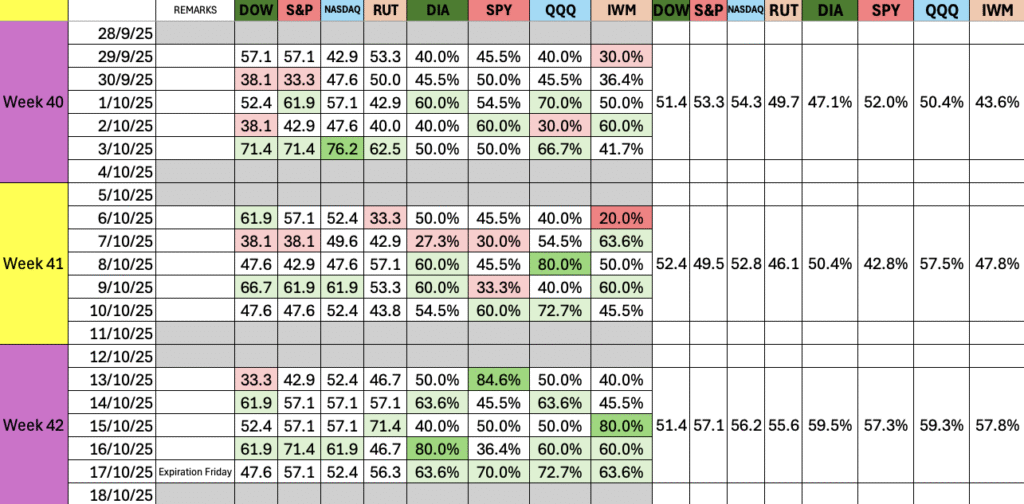

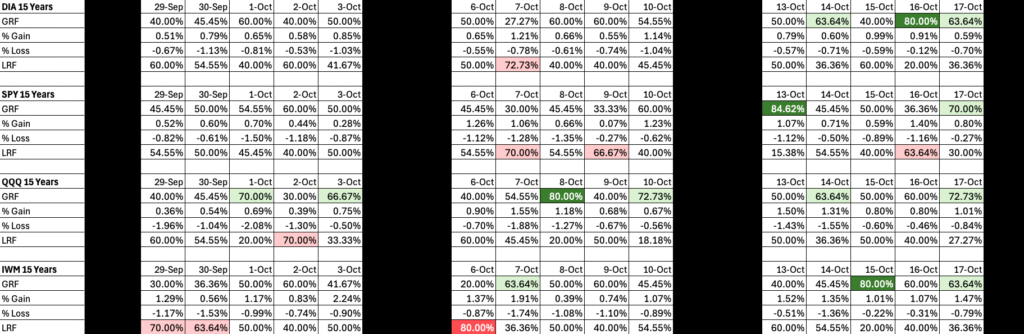

SEASONALS

WEEK 42:

We also have to keep in mind that with the current POTUS, the seasonals can go out of whack very easily.

*PTSD – Penguin Trader Seasonal Data.

BENCHMARK INDICES (21-YEAR AVERAGE)

The Stock Trader’s Almanac’s stats for the Benchmark Indices Week 42 over a 21-year average, and the PTSD’s stats for Index ETFs over a 15-year average; now with a weekly average.

BENCHMARK INDEX ETFs

The Penguin Trader Seasonal Data (PTSD) stats for the Benchmark Index ETFs for Week 42– 15 year AVERAGE.

ANALYSIS

PUT/CALL RATIOS

Any reading above 1.00 is regarded as bearish.

As a common practice amongst the professionals, it is worth noting that the big money indicators are reliably the Index and ETF Put/Call Ratios while the Equity Put/Call Ratios are mostly novice/amateur participation.

PRICE-TO-PRICE DIVERGENCE

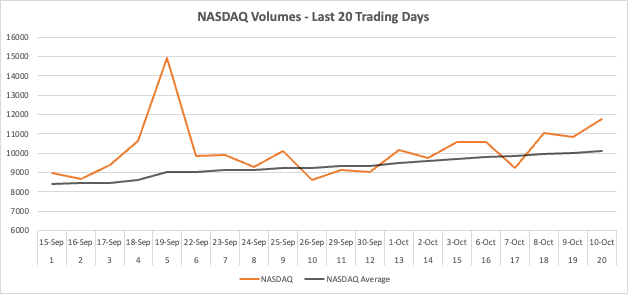

VOLUMES

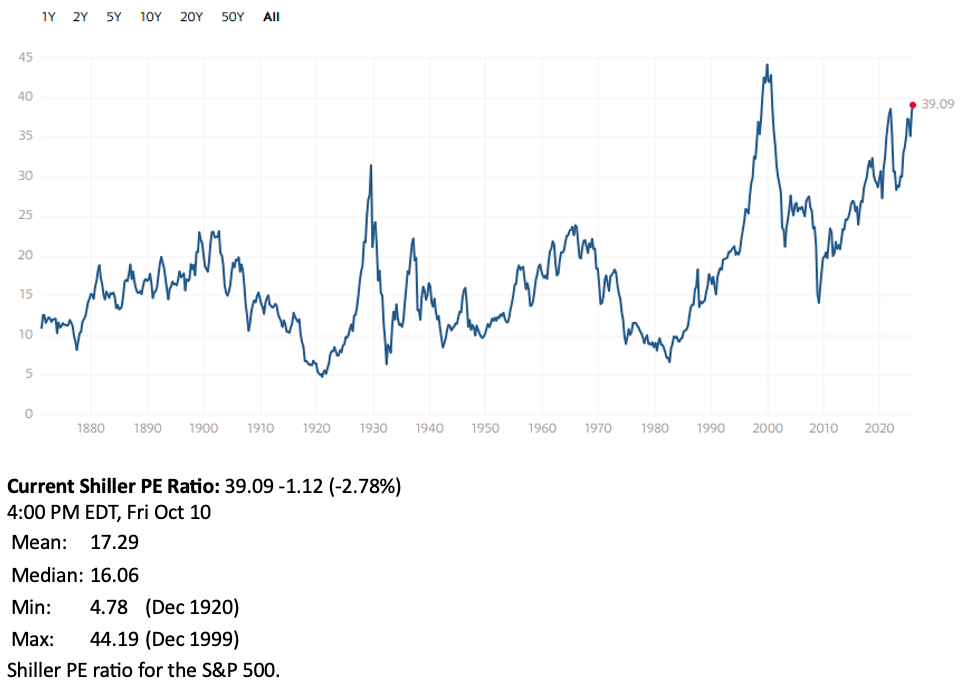

SHILLER PE RATIO

The Shiller PE Ratio, as of Fri 10 Oct, is at 39.09, at 2.47% lower than the previous week of 40.08.

This is more than double of its mean (17.29) and its median (16.06). At this level, the ratio is above the middle between the historical high (44.19) and the mean or the median. The U.S. market printed its third highest Shiller PE Ratio in its history at 40.08 last week on 3 October 2025. The largest bubble remains as December 1999 at 44.19.

DAILY MONITORING TABLE (Last 5 Weeks)

In this week, there were two bearish convergent sessions.

Over the last 5 weeks (25 trading sessions), there were 4 bearish divergent sessions, 6 bullish convergent sessions, and 15 divergent sessions (between the daily percentage changes and the market internals).

UVOL/DVOL and ADVANCES vs DECLINERS for NYSE and NASDAQ

From Monday to Thursday, the ratios of Uvol/Dvol and Advancers/Decliners on either side of the Bulls/Bears hovered between 1.0 to 2.0 (i.e. neither side was committed). Friday however favoured the Bears after Potus’ latest tariff announcement on China.

THE WEEK AHEAD

US Economic Releases

U.S. government data may be impacted by the shutdown. ‘Tentative’ events are subject to delay, revision, or cancellation.

- Mon 13 Oct

- Nothing of note

- Tue 14 Oct

- Fed Chair Powell Speaks

- Wed 15 Oct

- Empire State Manufacturing Index

- Thu 16 Oct

- Philly Fed Manufacturing Index

- Core PPI m/m

- PPI m/m

- Core Retail Sales m/m

- Retail Sales m/m

- Unemployment Claims

- FOMC Member Waller Speaks

- Fri 17 Oct

- Building Permits

- Housing Starts

International Releases

- Mon 13 Oct

- CN: New Loans

- AU: Monetary Policy Meeting Minutes

- Tue 14 Oct

- UK: Average Earnings Index 3m/y, Average Earnings Index 3m/y

- EU: German ZEW Economic Sentiment

- UK: BOE Gov Bailey Speaks

- CN: CPI y/y, PPI y/y

- Wed 15 Oct

- AU: RBA Gov Bullock Speaks, Employment Change, Unemployment Rate

- Thu 16 Oct

- UK: GDP m/m

- EU: ECB President Lagarde Speaks

- Fri 17 Oct

- Nothing of note

Week Ahead

Next week, markets will turn their attention to the start of the US earnings season, with major banks including Citigroup, Goldman Sachs, JPMorgan Chase, Wells Fargo, Bank of America, Morgan Stanley set to report results. Meanwhile, as the US government shutdown enters its third week, the release of key economic data such as CPI is expected to remain delayed. However, traders will still monitor other scheduled updates, including industrial production, the NAHB housing market index, the Philadelphia Fed and New York Fed manufacturing surveys, and the NFIB Small Business Optimism Index. In China, attention will turn to trade, inflation, and banking activity, while in Europe, investors will watch Eurozone industrial production, the final inflation reading, Germany’s ZEW sentiment index, and UK labor market and GDP data. Elsewhere, Japan’s political developments will remain in focus. The IMF will publish its World Economic Outlook.

Joana Taborda | joana.taborda@tradingeconomics.com 10/10/2025 3:03:27 PM

Americas

As the US government shutdown enters its third week, it is likely that the release of key economic data will remain delayed, including reports on CPI, PPI, retail sales, housing starts, building permits, and import and export prices. Still, traders will receive several updates from other institutions, such as industrial production, the NAHB housing market index, the Philadelphia Fed and New York Fed manufacturing surveys, and the NFIB Small Business Optimism Index. Meanwhile, the earnings season will kick off, with major banks including Citigroup, Goldman Sachs, JPMorgan Chase, Wells Fargo, Bank of America, and Morgan Stanley set to report results. Other key companies releasing quarterly updates include BlackRock, Johnson & Johnson, American Express, Abbott Laboratories, Progressive, and Charles Schwab. Several Federal Reserve officials are also scheduled to speak during the week, including Chair Powell, who will address the National Association for Business Economics (NABE) Annual Meeting. The US bond market will be closed on Monday for the Columbus Day holiday, while stocks markets will remain open.

Europe

The Euro Area’s industrial production for August is expected to contract after a modest rebound in July, highlighting persistent weakness in the region’s manufacturing sector. In Germany, the closely watched ZEW Indicator of Economic Sentiment is seen rising to 39.5 in October, marking a three-month high but still well below July’s 52.7, reflecting cautious optimism. Across the bloc, final inflation readings for October will be released. In the United Kingdom, a busy data week will bring key updates on the labor market and GDP. The unemployment rate is forecast to hold steady at 4.7%, its highest level since August 2021, while total average weekly earnings, including bonuses, are expected to remain unchanged at 4.7%. GDP is projected to expand 0.2% month-on-month in August after stalling in July, supported by rebounds in industrial and manufacturing output. Additional releases include Euro Area and Italian trade balances, Germany’s wholesale prices, and the UK’s BRC retail sales monitor.

Asia Pacific

It will be a busy week in China, with a flurry of economic data scheduled following the Golden Week holidays. Attention will center on trade figures, which are expected to offer insight into how shifting global trade policies are impacting activity ahead of the anticipated Trump–Xi talks later this month. Both exports and imports are expected to have accelerated in September, rising 6% and 1.5%, respectively, pushing the trade surplus slightly higher to around $99 billion. Meanwhile, deflationary pressures are seen easing, with CPI likely down 0.1% year-on-year and PPI expected to fall 2.3%. Monetary and credit indicators will also draw attention, with new yuan loans forecast to have more than doubled from the previous month. In Japan, a holiday-shortened week brings few releases, including final industrial production and machinery orders for August. Traders will also monitor political developments following reports that the Komeito Party plans to withdraw from the ruling coalition with the Liberal Democratic Party (LDP). In India, inflation data will take the spotlight, with consumer prices expected to slow to 1.7% from 2.07%, while wholesale inflation (WPI) likely held at 0.5%. In Australia, focus will shift to September employment data, projected to show a 17,000 increase in jobs alongside a slight uptick in the unemployment rate to 4.3%. The RBA meeting minutes will also be closely watched. Elsewhere in the region, investors await third-quarter GDP and September trade data from Singapore and Malaysia.

By joana.taborda@tradingeconomics.com | 2025 OCTOBER 10

COMMENTARY

There have been some issues I had to attend to in the nest, as well as my absence due to other family-based responsibilities. Against that, I had two major projects/presentations looming over me. These have been addressed. This is the best explanation I can post publicly online.

On the Home Front:

- I will be away on vacation for the next few weeks, so limited market data will be posted when I have internet access again.

Stay Hedged, my Penguin Friends.

(Excerpts from briefing.com, tradingeconomics.com, financialscents.com, factset.com, marketwatch.com, etrade.com, yahoo.com, tigerbrokers.com, tradingview.com, tradingcentral.com, theedgemalaysia.com, sectorspdrs.com, Investopedia.com, and CNBC.com)